🔥 This offer expires in:

🔥 This offer expires in:

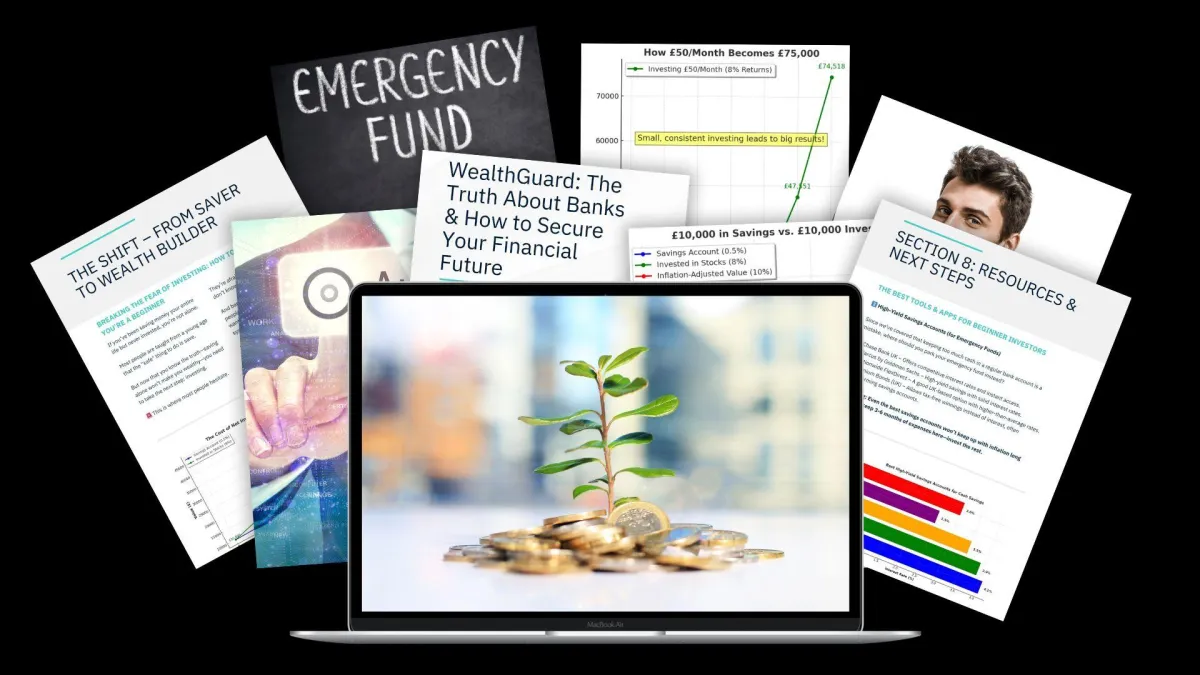

For Everyday ‘Savers’ Who Believe Keeping Money in

the Bank is the Best Way to Build Wealth

Why Keeping Money in the Bank is Costing You Thousands & How To Take Back Control of Your Financial Future

Without gambling on risky crypto, relying on outdated financial advice, or wasting hours trying to decipher confusing stock charts. WealthGuard is your step-by-step guide to protecting and growing your money the right way—even if you have no experience and no time to watch the markets.

INTRODUCING WEALTHGUARD

82% of 'Savers' Don’t Realize Their Money is Shrinking in the Bank — Fix It Today!

Your Bank is Not Helping You Build Wealth—It’s Helping Itself

Every year, millions of everyday savers unknowingly lose purchasing power because their money sits in a low-interest savings account while inflation skyrockets. You deposit your hard-earned cash, trusting the bank to keep it safe—but with inflation averaging 10% in recent years and savings accounts offering as little as 0.5%, your money loses value every single day.

Meanwhile, banks take that same money and lend it out at rates up to 10X higher than what they pay you , profiting while you fall further behind. This guide exposes the

truth about traditional banking and reveals a better way.

Instead of watching your wealth erode in a savings account, discover proven investment strategies that allow you to

grow your money safely, outpace inflation, and finally take control of your financial future - without needing to gamble on crypto, learn complex stock charts, or trust a financial advisor who only cares about commissions.

It’s time to stop letting banks win and start building real financial security on your terms.

The Hidden 10% Loss You Can’t Afford to Ignore

Every year, millions of savers unknowingly lose money just by keeping it in the bank. With inflation averaging 10% in recent years and savings accounts offering as little as 0.5%, your hard-earned cash is losing value daily. This guide reveals simple, safe investing strategies that consistently outpace inflation, ensuring your money grows instead of shrinking over time.

Gain Access to Wealth-Building Strategies Used by the 1%

The wealthy don’t leave money sitting in banks. Instead, they invest in high-yield opportunities that multiply their wealth over time. This guide unlocks the same wealth-building strategies used by the top 1%, showing you how to grow your money without needing millions to start or a finance degree to understand it.

Banks Are Lending YOUR Money at 5-10X the Rate And Keeping the Profits

You see that number in your bank account? Your bank doesn’t just hold onto it—they lend it out at rates 5-10X higher than what they pay you in interest. While they make huge profits, you earn a pathetic 0.5% return—which isn’t even keeping up with inflation. This guide shows you how to flip the script and make your money work for YOU, not the banks.

Invest in Under 5 Minutes a Week—Without the Stress

Moving from traditional savings to high-return investments doesn’t have to be complicated. Even though banks want you to think investing is risky or difficult (wonder why?), this guide breaks it down into simple, stress-free steps. You’ll learn how to automate your investments and manage your portfolio in less than 5 minutes a week—no market research, no confusing strategies, just results.

MORE THAN JUST A PDF

The Truth About Money: Your Financial Wake-Up Call

Right after your purchase, you'll receive the link to download your

WealthGuard PDF in just a few clicks!

Why Keeping Money in the Bank is Keeping You Broke

What You’ll Discover in This Section:

The Hidden Dangers of Traditional Banking

How Savings Accounts Quietly Drain Your Wealth

The Financial Game Banks Don’t Want You to Understand

Why Keeping Money in the Bank is Costing You More Than You Think

What You’ll Discover in This Section:

How Inflation is Silently Draining Your Savings

The Hidden Fees & Charges Banks Don’t Want You to Notice

The Smarter, Safer Alternatives That Grow Your Wealth Faster

The Hidden Cost of Not Investing

What You’ll Discover in This Section:

Opportunity Cost – What You Miss by Not Investing

The Power of Compounding

The Wealth Gap – Why the Rich Invest While the Middle Class Saves

Comparing HYSA Rates vs. Inflation Rates

The Illusion of Growth – Why High-Yield Accounts Don’t Solve the Problem

The Alternative That Actually Beats Inflation

Breaking the Fear of Investing

What You’ll Discover in This Section:

The Biggest Myths That Keep People from Investing

What Millionaires Do Differently

The Safety-First Strategy for First-Time Investors

Stocks vs. Savings – The Numbers That Prove It

How to Start Investing with as Little as £50/Month

The Best Beginner-Friendly Investment Options

The Simple Approach – Index Funds & ETFs Explained

Why You Don’t Need to “Time the Market” to Win

The Easiest Set-It-and-Forget-It Wealth-Building Strategy

Avoiding Costly Mistakes: The Investing Pitfalls That Keep People Broke

What You’ll Discover in This Section:

The Five Biggest Investment Mistakes That Drain Your Wealth

Why Keeping Too Much Cash is Riskier Than Investing

The Truth About “Timing the Market” – Why It Doesn’t Work

High-Risk Investments to Avoid if You Want Long-Term Growth

Emotional Investing – How Fear and Greed Wreck Your Returns

How to Build an Investing Strategy That Works in Any Market

Building Long-Term Wealth: The Blueprint for Financial Security

What You’ll Discover in This Section:

The Power of Consistency – Why Small Investments Lead to Big Results

The Rule of 72 – How to Predict How Fast Your Money Will Double

Automating Your Investments – How to Grow Wealth Without Thinking About It

The 50/30/20 Rule – A Simple System to Balance Saving, Investing, and Spending

How to Adjust Your Investment Strategy as You Build More Wealth

The End Goal – How to Achieve Financial Independence and Retire Early

Mastering Your Money: How to Take Control of Your Financial Future

What You’ll Discover in This Section:

How to Create a Bulletproof Investment Plan That Matches Your Goals

Building Wealth Without Watching the Markets Every Day

The Most Important Financial Habits That Lead to Long-Term Success

How to Stay on Track and Adjust Your Strategy as You Grow

The Step-by-Step Guide to Securing Your Financial Future Today

Your Wealth, Your Future: The Final Steps to Financial Freedom

What You’ll Discover in This Section:

The 30-Day Action Plan – How to Implement What You’ve Learned

Common Roadblocks and How to Overcome Them

How to Make Investing a Lifelong Habit

The Power of Patience – Why Long-Term Thinking Wins

Your Personalized Financial Freedom Roadmap

READY TO GET STARTED?

Get The WEALTHGUARD PDF Today!

You Have Two Choices Right Now:

🚫Keep doing what you’re doing - leave your money in the bank, let inflation shrink its value, and watch the banks profit while you fall behind.

✅Or take action today - start growing your money with a simple, safe strategy that builds real wealth without stress or confusion.

WEALTHGUARD PDF

$17 USD

VAT/Tax Included

Still Got Questions?

Here's The Answers

What Will This Guide Teach Me?

This guide reveals why keeping money in a traditional bank account is costing you wealth and how the rich grow their money faster with proven investment strategies. You’ll get a step-by-step roadmap to moving beyond low-interest savings, building passive income streams, and making your money work for you - without gambling on risky investments or needing expert knowledge.

Is This Guide Suitable for Beginners?

Absolutely. This guide is designed for anyone looking to take control of their finances, whether you’re just starting or already have some investing experience. Everything is explained in clear, simple terms with step-by-step actions - so you can start building wealth without confusion, complexity, or financial jargon.

Do I Need Lots of Money to Start?

No! You’ll discover how to start investing with as little as £50/month and grow your money over time - without needing a huge lump sum or risking everything at once.

How Quickly Will I See Results?

Cutting hidden banking fees can save you money instantly, while smart investing strategies take time to grow. By taking consistent action, most people start seeing real financial improvements within the first few months, setting the foundation for long-term wealth.

I’m Already Investing, Will I Get Anything from this PDF?

Absolutely. This guide goes beyond the basics and reveals how the top 1% maximize their returns while avoiding costly mistakes. You’ll uncover hidden wealth-draining pitfalls and learn advanced strategies to optimize your portfolio, boost passive income, and ensure your investments are working at their full potential.

How Is This Different from Free Advice I Can Find Online?

Good question! Unlike scattered tips and conflicting advice online, this guide brings everything together in one clear, actionable roadmap. You’ll get proven, research-backed strategies that the wealthy use, along with step-by-step instructions to grow your money—without wasting hours trying to figure it out on your own.

Is There a Guarantee if I’m Not Satisfied?

Since this is a digital product, refunds aren’t available - but we stand behind the value inside. The strategies in this guide are designed to help you save and grow your money immediately.

All rights reserved WEALTHGUARD

Disclaimer:

This guide is provided for informational purposes only and does not constitute financial, investment, or legal advice. The content is based on research and personal experience and is intended to share general information about financial concepts and strategies. Individual financial situations vary, and it’s important to consult a qualified financial advisor before making any investment or financial decisions. We do not guarantee specific results, and all investments carry risk. The creators and distributors of this guide are not responsible for any losses or damages resulting from actions taken based on its contents.

TikTok